We are moving in the era Blockchain where the world is decentralized, trustless, transperant and fast. But the revolution started by bitcoin is still limited and has few inherent flaws which are stopping major financial houses to adopt this digital currency. There has been an improvement in the world of cryptocurrency after the launch of Ethereum. The speed of transaction takes minutes to process which is a major hindrance to the mass adoption of this technology.

Whereas the transaction based on credit cards is much faster. The biggest problem faced by business in transactions is network latency if they use the current form of cryptocurrency based technology for payment processing and fund transactions. What latency means is actual response time when compared to expected response time. Another key issue is the bandwidth, the current form of the system can only handle a limited amount of transactions per second. The current form of the system which is based on bitcoin and blockchain network takes more than 10 minutes on an average. The second key issue is of cost which has an inherent role in every project and currently the cost is high for cryptocurrency adoption on a large scale which inhibits many businesses to utilize the advantages of the digital currency.

Solution Offered

We are here with the latest and unique technology presented by a company which is a low-cost transactions per second by employing blockchain principles. It aims to make cost 10000 times cheaper by employing smart contracts which are self-executable. it has its own internal cryptocurrency called CREDIT cryptocurrency.

It is specifically aimed at the financial industry and MVP is ready along with project prototype.It believes it can reduce the operational cost of micropayments and the internet of things by about 0.01%. The credits platform developed by the company is the most developed system of the most cryptocurrent system.

Advantage

CREDITS provides a decentralized platform for financial institutions to perform their business operations based on peer to peer network based on smart contracts. It does this while creating a network ledger where all the distributors are networked. The network of consensus is formed when all connected nodes on the network take part in the group decision-making process to find better solutions to the given problem. The required steps to manage ledger on the CREDITS platform can be summed up as mentioned below.

- The user of the platform generates a transaction.

- The required conditions of smart contract based on software and network consensus mode are enabled by the platform.

- The block is sent into the consensus module. The block is sent into the consensus module.

- After validation of the candidate in the block, it is added to the ledger where the hash is a kind of signature to identify the source for the certification.

- Using federative search algorithm, the transactions of the block goes into the validator's kernel to be written into the ledger.

A smart contract is a digital contract where predefined terms and conditions agreed between two participants who decide to perform transfer of a value. In CREDITS there are two entities involved in the process of smart contract; the first one is property (public variable) the system which has required data for execution of the smart contract and the second one is METHOD which observes the logic and consequence of the smart contract being performed on the CREDITS platform.

ICO Token Information

There will be ICO based on ethereum platform to quickly design and develop the project of CREDITS to enhance and enable the large-scale use of our platform. The pre-ICO time is scheduled in October and ICO will be conducted in two phases; first on nov-dec 2017 and second in the second quarter of 2018. There will be 75% token distribution through ICO.

CROWDSALE

ICO

- PRE-ICO – October 2017

- ICO Round 1 – Nov-Dec 2017

- ICO Round 2 – 2Q 2018.

ICO will be conducted on the Ethereum platform in the ERC20 standard with the subsequent replacement with the internal CREDITS cryptocurrency.

Why should you invest?

Today, the business is changing rapidly in every sector that takes us to receive the latest technological advances and be at the forefront of innovation; This platform presents a unique opportunity to bring our business to a new global level that was not possible before. A distributed ledger that can save millions of dollars for your company is ready to be implemented by the CREDIT platform. We have a choice here, whether we can be part of the next big revolution of the future business or do not want to accept change and stay where we are. Everyone thinks business and it's right on your desktop.

Why should you invest?

Today, the business is changing rapidly in every sector that takes us to receive the latest technological advances and be at the forefront of innovation; This platform presents a unique opportunity to bring our business to a new global level that was not possible before. A distributed ledger that can save millions of dollars for your company is ready to be implemented by the CREDIT platform. We have a choice here, whether we can be part of the next big revolution of the future business or do not want to accept change and stay where we are. Everyone thinks business and it's right on your desktop.

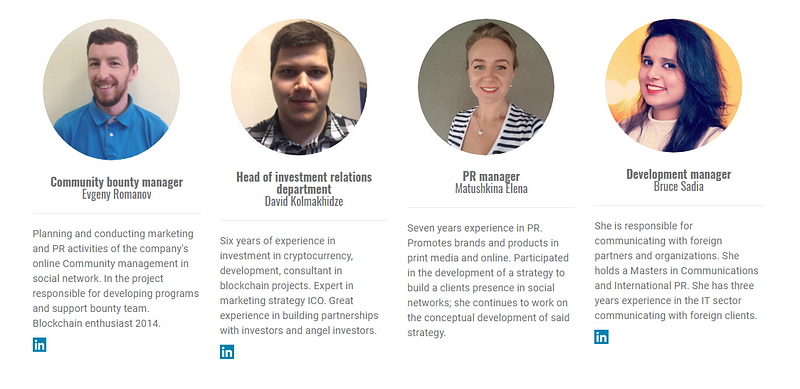

Team

The team consists of entrepreneurs and engineers who have decade-long experience in the field of finance and entrepreneurship and it adds to their strength in this project that they are supported by well-experienced advisors and government officials of Singapore.

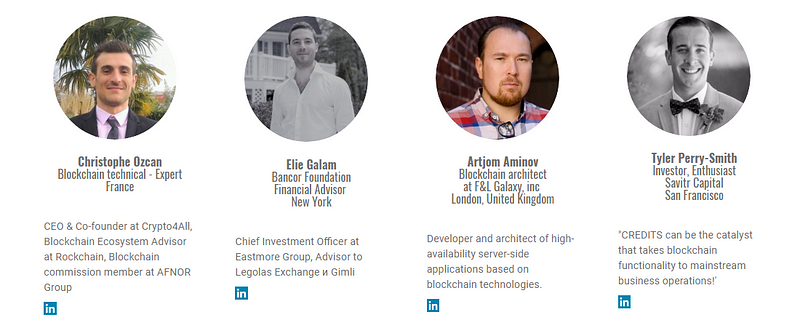

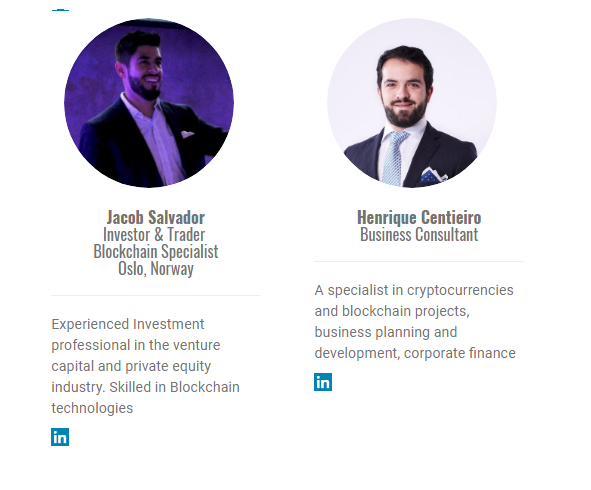

Advisor

For More Detailed Information Can Visit Link Below:

- Website: http://credits.com

- Linked In: https://www.linkedin.com/company/13370238/

- Twitter: https://twitter.com/CreditsCom

- Facebook: https://www.facebook.com/creditscom/

- Telegram: https://t.me/creditscom

- WhitePapper: https://credits.com/Content/Docs/TechnicalWhitePaperCREDITSEng.pdf

- ANN Thread: https://bitcointalk.org/index.php?topic=2190887

My Profile link:https://bitcointalk.org/index.php?action=profile;u=1110718

ETH Address: 0xB5fAce1cdD8D68803F9d835e0C17035C44762d5c

EmoticonEmoticon